Feeling frustrated by traditional lenders saying “no” to your loan requests because of past credit hiccups? You’re not alone. Many self-employed individuals and business owners face this exact challenge, struggling to get the fair go they deserve.

At Fox Finance Group, we specialise in helping businesses like yours. We understand that a less-than-perfect credit score shouldn’t be a roadblock, and we’re here to help you get the business vehicle you need!

Bad credit business car loans are for people with low credit scores or limited credit history. If you’ve missed bills or repayments in the past, your score may have dropped, but that doesn’t mean you don’t deserve another chance.

A bad credit loan gives you and your business the chance to get the vehicle you need. They can come with flexible loan terms and are tailored to fit your unique financial situation, not just your credit score. When working with a brokerage like Fox Finance Group we have access to a panel of 50 plus lenders who can help with credit challenged auto loans for your business.

A business car loan is a dedicated loan used specifically for a work purpose vehicle. This could be a delivery van, work truck, or company car, anything that helps you run your business more effectively.

Here are three ways a business car loan can help:

Bad credit car loans for your business are a powerful way to shape your financial future. Beyond simply getting the vehicle you need, these loans give you an opportunity to actively rebuild your credit score. Each on-time repayment made helps lay a solid foundation for improving your credit, as it is reported to the major credit bodies like Equifax, Experian, and Illion.

By repaying a bad credit loan for your business on time and consistently, you are showing future lenders that you’re managing your finance responsibly. Over time, this can lead to an improved credit score, potentially qualifying you for lower interest rates and better loan terms in the future.

As part of our assessment process, we’ll provide you with a copy of your credit file and walk through it with you so you understand exactly what your credit score is. If you are looking for more ways on how to improve your credit and understand how it works, read Moneysmarts article ‘Credit Scores and Credit Repairs’ where they provide helpful information around how your credit score is calculated to how to fix mistakes.

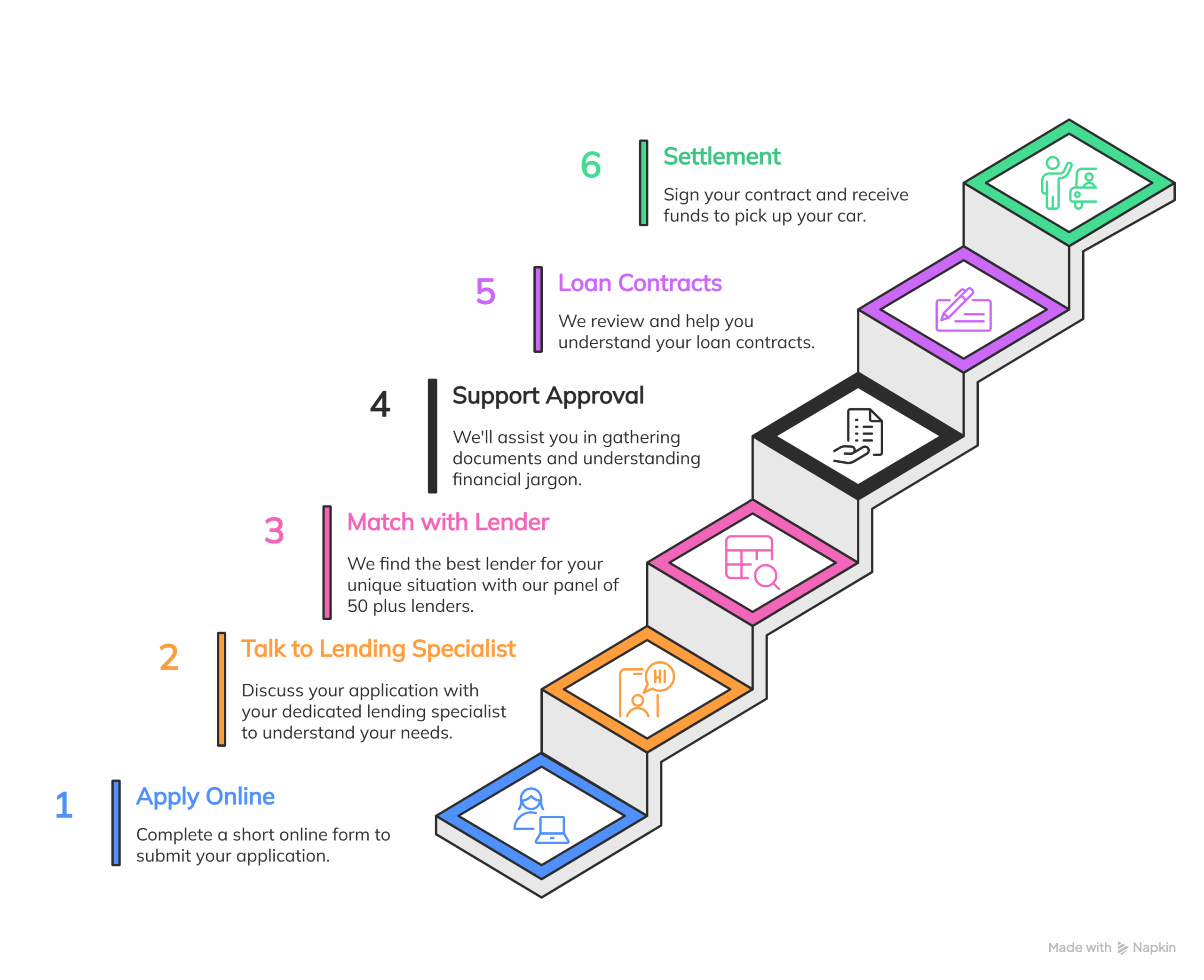

Here’s a simple step-by-step breakdown of what usually happens when you apply for your bad credit business car loan:

Don’t let past credit bumps stop you from getting the car your business needs. It’s quick and easy to apply, even if your credit isn’t perfect.

Give it a go and apply now!

|

Rowdie Lang |

Rowdie has been a part of our Team since 2020. He has witnessed firsthand the ongoing evolution of the finance industry as technology continues to change the way customers' access financial services. He has a passion for helping people and relishes the opportunity to work alongside our teams every day as they help our customers financial dreams come true. |

|

Reviewed by: Nathan Drew ✅ Fact checked 📅 Last updated: Aug 22, 2025 |

|