Owning a caravan is a dream for many Australians, offering the freedom to explore the country on your own terms. Trying to get a caravan loan though by yourself can be stressful with all the lenders to choose from, loan options, and financial factors to consider, it can all become overwhelming.

You want someone in your corner like Fox Finance Group who will help you with your caravan loan to make sure it fits your needs the best. That’s why we put together this guide to the 5 key areas to consider when getting a caravan loan.

With caravan finance, establishing a budget is important before committing to any loan agreement. Begin looking at your monthly income and keep track of all recurring expenses to determine your financial capacity. It will be key to account for everything that comes with caravan ownership, far beyond just your repayment amount.

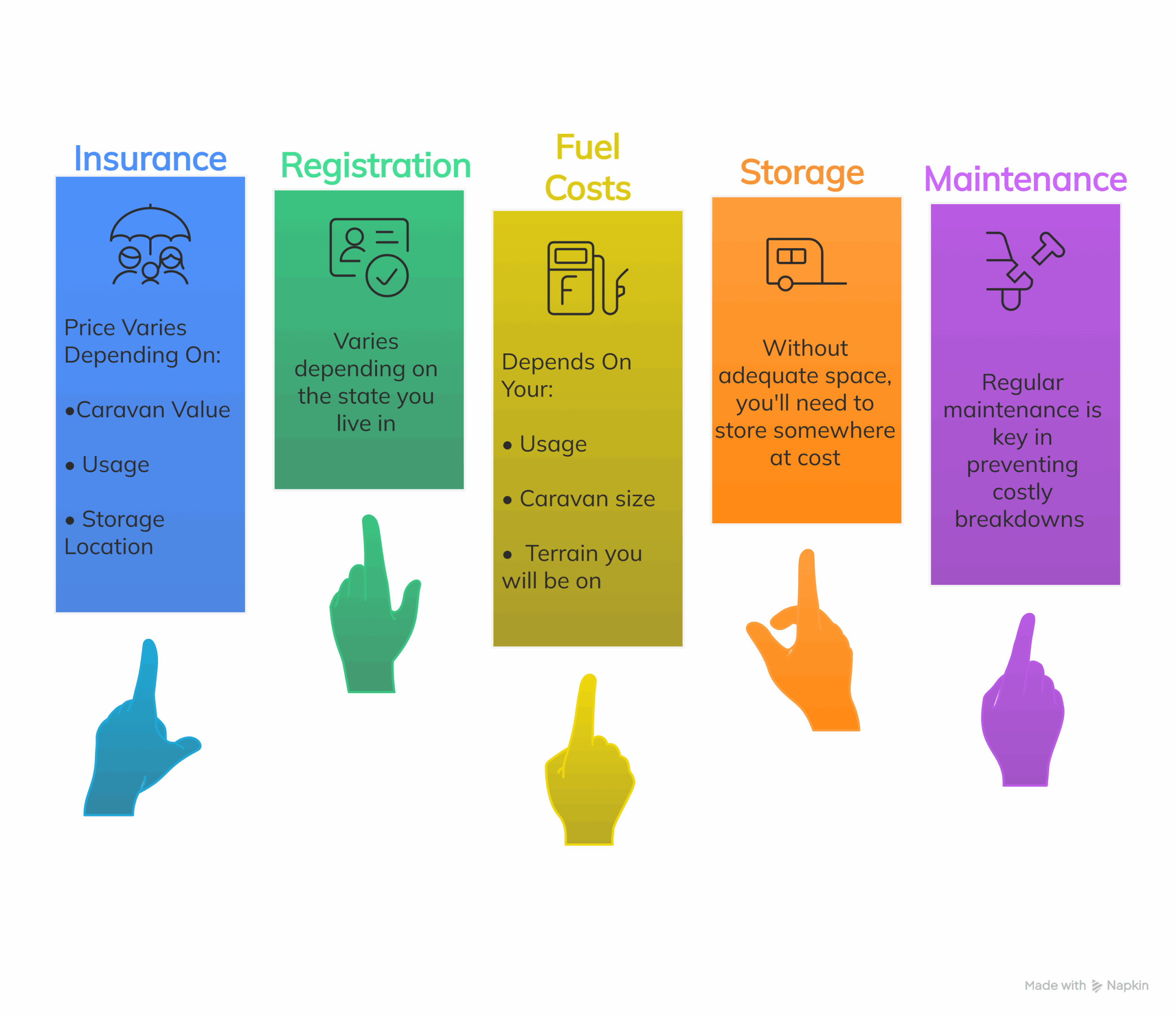

You’ll want to consider some of the following:

Factoring these costs into your budget provides a realistic picture of total caravan ownership expenses.

Caravan loan interest rates play an important role in determining the overall cost of your loan. Rates vary between lenders and depend on various factors, including your financial profile, loan terms, and market conditions. When evaluating interest rates, here are two key considerations:

Caravan loans generally fall into two categories, which are secured or unsecured loans. Each with advantages and disadvantages.

Secured caravan loans is where your new caravan is used as the collateral against the loan. This means your lender has a legal claim over the caravan until the loan is fully repaid. Because of this, these loans usually come with:

Unsecured caravan loans do not require the caravan to be used as collateral. This means your lender is unable to take your caravan if you stop making payments. Lenders will instead pay extra attention to your overall creditworthiness, looking closely at your income, previous and current repayment history, and credit history.

These loans come with:

When considering a caravan loan, lenders evaluate new and used caravans quite differently. Understanding the difference can impact your loan terms and overall cost. Here’s what you should think about for each option:

Another option in the new caravan range is to build your dream caravan. This gives you the flexibility to add in all the tech and comforts you are looking for. Our partner Australian Off Road Caravans delivers top of the line off road units so you can make your dream caravan come true!

Want to dive deeper into the world of caravans? Caravan World Magazine is your go-to resource, packed with insightful reviews, expert advice on towing vehicles, and some must-visit destinations to fuel your journey.

Make sure to closely examine all the fees and charges that may be associated with your loan. These fees can significantly affect the overall cost of borrowing, so understanding them upfront will help you avoid surprises. Common fees to look out for include:

Don’t hesitate to ask us questions on your terms or fees. Some loans might seem appealing at first due to low interest rates, but high or hidden fees could make them more expensive over time.

Apply today to start your caravan journey!

Looking for the best caravan parks in Queensland? We’ve done the research for you. Check out our guide to the “Top 8 Caravan Parks in Queensland” and start planning your next getaway.

|

Rowdie Lang |

Rowdie has been a part of our Team since 2020. He has witnessed firsthand the ongoing evolution of the finance industry as technology continues to change the way customers' access financial services. He has a passion for helping people and relishes the opportunity to work alongside our teams every day as they help our customers financial dreams come true. |

|

Reviewed by: Nathan Drew ✅ Fact checked 📅 Last updated: Jun 17, 2025 |

|