Life throws curveballs, and sometimes those curveballs can hit your credit score. If you’ve faced financial challenges in the past, you might feel like getting a car loan is an uphill battle. You may even be asking yourself the question “how do I even get a car loan with bad credit?”. The good news is here at Fox Finance Group we’ll help guide you to success.

We understand that your past credit history doesn’t always reflect your current financial stability or your desire to move forward. We specialise in bad credit car loans, helping everyday Australians get into the car they need.

Simply put, bad credit car loans are designed to help individuals with less-than-perfect credit history. This could be due to missed payments, defaults, or even bankruptcies in the past. While many banks might automatically decline your application because of these marks, specialised lenders like the ones we have on our panel, look beyond just your credit score.

Lenders who specialise in bad credit loans value your financial situation, your repayment ability, and your commitment to achieving a fresh start. This means you’ll still have options for your credit challenged auto loan.

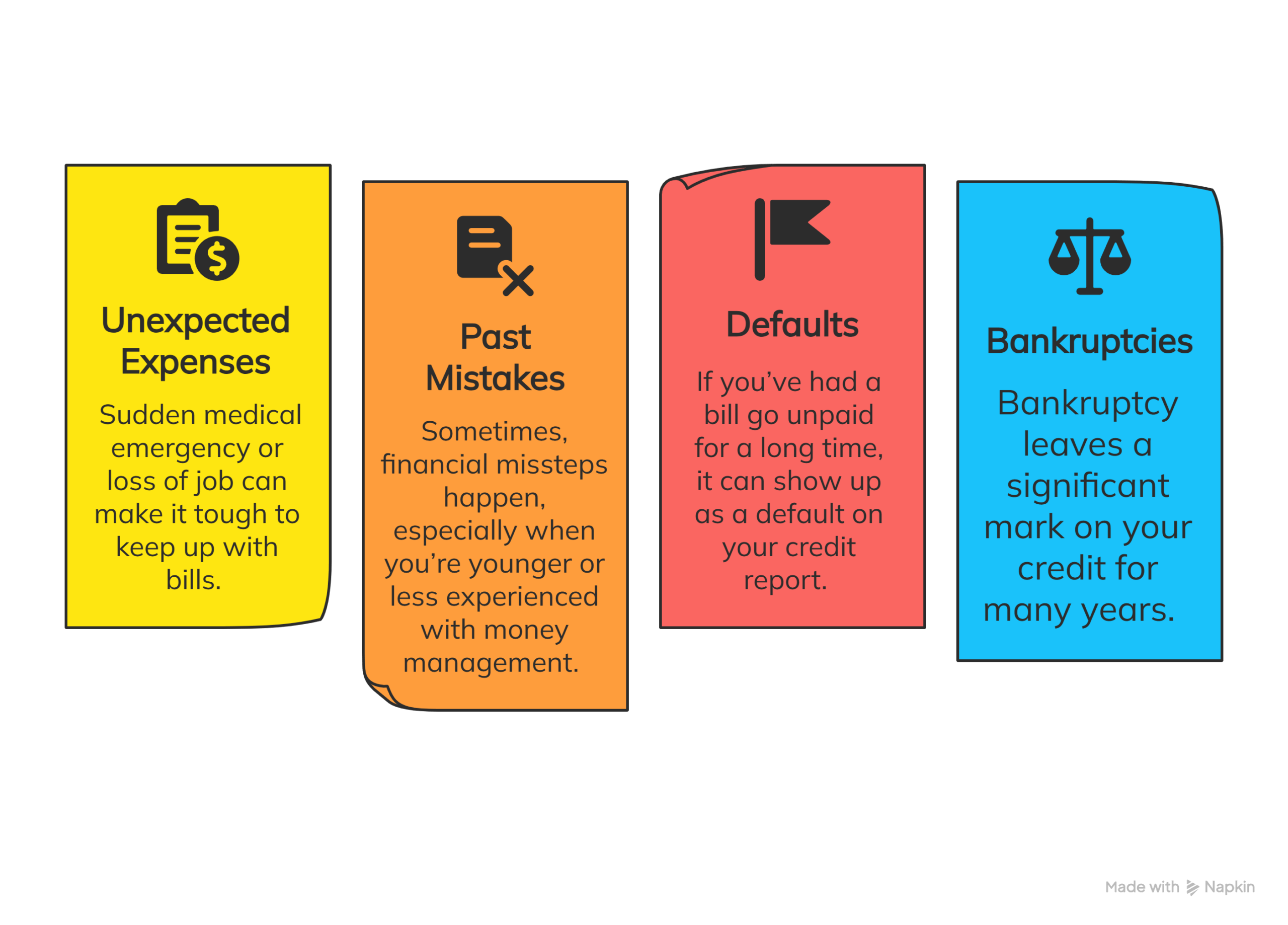

Some people end up with bad credit car finance because issues in life happen, and it can lead to a poor credit score for various reasons, such as:

No matter the reason, having a low credit score shouldn’t stop you from getting reliable transportation, especially if a car is essential for your job, family, or daily life. If you are looking for a deeper dive on understanding your credit score check out our blog “Guide to Understanding Your Credit Score” where we break down everything you need to know, from what is a credit score to how you can improve yours.

When applying for bad credit car loans, your bank statements are one of the most important documents you can provide. Think of them as a snapshot of your financial life. Lenders use them to understand your income, spending habits, and how you manage your money. This helps them decide if you are able to afford your loan repayments.

Here’s what lenders typically look for and how you can prepare:

It’s a good idea to have a pre-look through your statements and make sure everything is accurate in reflecting your income and regular expenses. If there’s anything unusual, be ready to explain it to your lending specialist. Being open and honest about your financial situation, supported by clear bank statements, can significantly strengthen your application for credit challenged auto loans.

Applying for a bad credit car loan might seem complicated, but we’ve made the process incredibly straightforward with our six simple steps designed to get you behind the wheel as quickly and smoothly as possible:

Don’t let past credit issues hold you back from owning the car you need. We’re here to help you navigate the world of bad credit car loans and find a solution that works for you.

Apply now, even if you think your credit isn’t perfect, just give it a try!

|

Rowdie Lang |

Rowdie has been a part of our Team since 2020. He has witnessed firsthand the ongoing evolution of the finance industry as technology continues to change the way customers' access financial services. He has a passion for helping people and relishes the opportunity to work alongside our teams every day as they help our customers financial dreams come true. |

|

Reviewed by: Nathan Drew ✅ Fact checked 📅 Last updated: Aug 22, 2025 |

|

Lenders want to see your current financial situation, including stable income and expenses shown in your bank statements. They care more about your present ability to repay your loan and not past credit issues.

First, you apply and fill out our quick online form. Then, you talk to one of our dedicated lending specialist who helps find the right lender for you. We will guide you through getting approved, gathering papers, settling, and beyond.

The biggest benefit is that it helps people who need a car for work or daily life obtain one, even if past financial difficulties made it hard to get a loan before. A bad credit car loan can also help rebuild your credit score if you make your payments consistently and on time.